Event Calendar

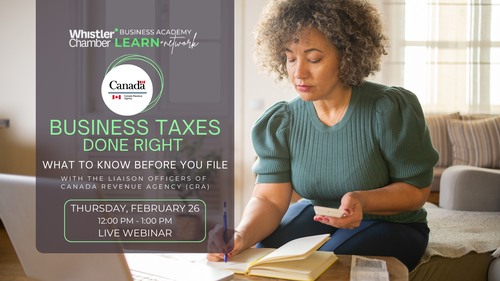

Business Taxes, Done Right: What to Know Before You File

Date and Time

Thursday Feb 26, 2026

12:00 PM - 1:00 PM PST

Location

Live webinar via Microsoft Teams (The link will be shared with registered participants 48-hours prior to the webinar)

Fees/Admission

Members $15 | Future Members $20

Note: The CRA delivers this session at no cost. Registration fees support the Whistler Chamber to cover administrative, marketing, and staffing costs.

Contact Information

Whistler Chamber Team

Send Email

Description

Wouldn't it be great to know you're doing things right before you file your small business tax return?

The Whistler Chamber is thrilled to host the Liaison Officers of Canada Revenue Agency (CRA) for a live Webinar, designed specifically for small business owners and self-employed individuals to get their tax-related questions answered - in real time!

This interactive session provides practical guidance to help you better understand your tax obligations, identify possible deductions, and avoid common errors that can cost you time and money. CRA liaison officers are available across Canada to support business owners ? and this session brings that support directly to our local business community.

In this session, a CRA Liaison Officer will:

- Answer tax-related questions related to income tax, GST/HST, and payroll

- Discuss business tax deductions

- Explain common tax errors and relevant financial benchmarks

- Provide an overview of helpful CRA tools and services

- Explain general bookkeeping concepts and best practices

Whether you?re newly self-employed or running an established small business, this session is a valuable opportunity to gain clarity, confidence, and practical insight directly from the CRA.

Spaces are limited - register today, and ensure you save time, and money this tax year!